There are certain ideas that stay with you over a career. For me, one of those has always been the four Ps of marketing: Product. Price. Place. Promotion.

I never thought of them as a checklist or a set of answers. Instead, they served as a mental anchor – a way to organise messy problems, highlight trade-offs, and create a shared language that encouraged open discussion.

I remember distinctly the first time I leaned on them as a framework, at a moment when I wasn’t at all confident in myself. It was my first “proper” job, working as a junior marketer at the WD‑40 Company. I had been asked to write the annual marketing plan for France, and I can still recall the cold sweat that came with it. I was proud to have been given the chance, but quietly terrified.

I knew the team – and my boss – half-expected me to make mistakes. So I focused on one thing: structure. I figured that if I could organise my thoughts clearly, even imperfect ideas would make sense. That approach worked. There were many revisions and comments, but the main ideas stayed, and much of my work ended up in the final plan.

I think the 4Ps of Marketing have lasted because they are not just tactics. They don’t tell you what to do; they help you think. Most importantly, they offer a discipline that links key decisions to long-term results.

Over the past year, through Soldo’s People Like You conversations, I’ve spent a lot of time listening to CFOs and senior finance leaders. It’s a privilege that comes with my role at Soldo, giving me a front-row seat to how finance leadership is changing in real life. I don’t join these conversations to tell finance how to do its job – I wouldn’t date. Instead, I approach them with curiosity.

Today, finance is expected to do a lot: enable growth, support speed, drive transformation, and still protect the business from real risks. What stood out to me wasn’t a lack of ambition or skill, but a familiar tension. Expectations for finance have changed quickly, but the ways of thinking about those expectations haven’t always kept up.

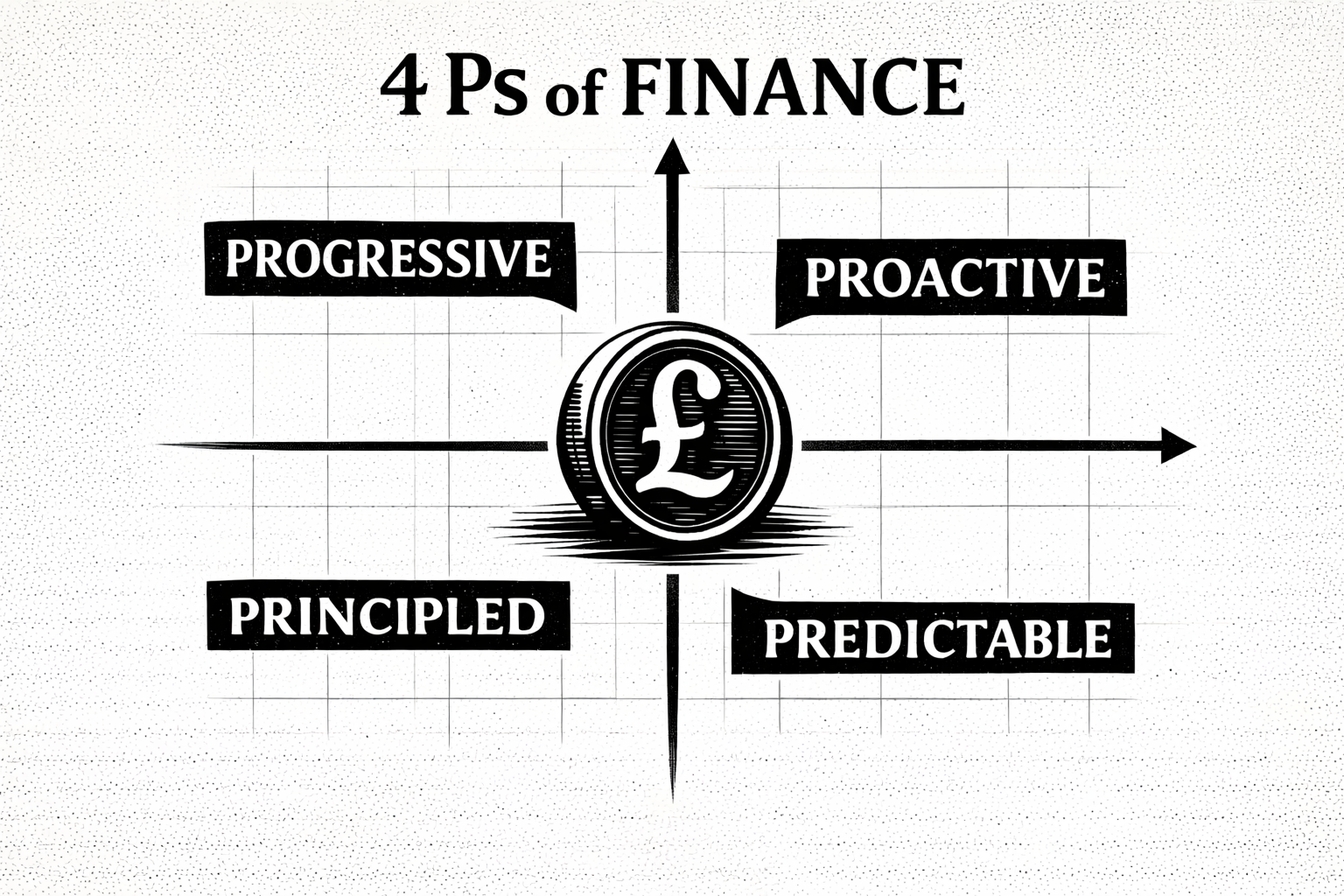

This made me ask a simple question: If marketing has the four Ps to guide decisions, is there a similar framework for thinking about the role of finance today?

What came out of this was a way to organise what I was hearing—a leadership perspective that shows how many finance teams are already changing in practice.

Progressive – Rethinking control in a world that moves faster

When finance leaders talk about being more progressive, it’s never about letting go of control. More often, it’s about rethinking how control shows up.

In many organisations, growth now happens at the edges. Decisions are made closer to customers, partners, and daily operations. Teams need to act quickly, not wait for long approval processes. At the same time, trust without structure isn’t really an option for Finance.

The best approach seems to be making a real effort to balance that tension. Progressive finance gives teams space to move quickly, while keeping finance in control. Manual expense reports, reimbursements, and after-the-fact checks are starting to feel outdated, replaced by systems that support independence while retaining oversight.

In this sense, progress isn’t about spending more. It’s about spending with purpose, quickly, and in line with strategy—safely, within clear limits, and with finance staying in control.

Proactive – Reducing risk before problems appear

Control is also where many traditional finance models begin to show their limits.

In the situations CFOs often describe, money moves first and issues show up later. Corrections come afterwards, sometimes weeks after decisions are made, when it’s too late to change the outcome.

Proactive finance takes a different approach. Instead of asking what went wrong at the end of the month, it focuses on shaping decisions before money is spent. Policies, limits, categories, and approvals are set in advance, so risk is reduced from the start instead of being managed later.

Finance leaders tell me this shift can be quietly transformational – not just for operations, but for company culture too. When expectations are clear and controls are predictable, trust grows. There’s less firefighting, fewer tense conversations, and finance is more often seen as a partner in getting things done.

In that sense, proactivity doesn’t weaken control. It’s what allows control to scale.

Predictable – Creating confidence through clarity, not caution

Predictability comes up in these conversations with striking consistency.

It’s not just an abstract idea, but a real source of credibility – with teams, the CEO, and the board. Predictability isn’t about removing all uncertainty; it’s about cutting down on surprises and creating clarity the business can trust.

When spending is decentralised but controlled, tracked in real time, and categorised at the source, finance gets visibility it can rely on. There are fewer accruals, fewer last-minute questions, faster month-ends, and forecasts based more on evidence than guesswork.

What stands out is how often people say predictability leads to better conversations. When the numbers are trusted, discussions move forward. Finance leaders spend less time explaining the past and more time helping the business plan for the future.

Principled – Making values visible in everyday decisions

The final P is where this way of thinking gains its depth.

People often describe principled finance as stewardship. It means making sure spending decisions reflect the organisation’s values as well as its budgets. This is where governance, ethics, and responsibility move from policy documents into daily actions.

As expectations for transparency, compliance, and ESG grow, principles work best when they are put into practice. Every transaction should have an owner, a purpose, and a reason that fits the situation.

Paperwork by itself rarely builds trust. Trust is more likely when principles are built into how money moves through the business.

Why the four Ps matter now

Frameworks last not because they make things too simple, but because they give people a shared way to think about complex trade-offs. Marketing adopted the four Ps because growth required clearer choices and a common language.

Finance feels close to a similar inflection point. It’s not that there is one right model, but finance leaders are more often asked to explain to the business and to themselves how they balance empowerment with control, speed with safety, and ambition with responsibility.

Seen through that lens:

- Progressive finance supports the business without stepping away from control.

- Proactive finance reduces risk before it materialises.

- Predictable finance builds confidence and credibility over time.

- Principled finance earns trust through everyday decisions.

Together, these four Ps don’t change what finance is. They simply offer a way to describe how modern finance leadership works.

Finance is not a back-office function, but a strategic capability.

If this way of thinking leads to agreement, disagreement, or a different view, I’d truly welcome the conversation.For me, that conversation is at the heart of my work at Soldo: helping finance teams move from looking back to leading, and making the trade-offs they face every day more visible, intentional, and human. This way of thinking offers finance leaders a language to articulate not just what they do, but why it matters.

Leave a Reply